The challenge is to digitally engage wealthy banking clients without human encouragement

CONVERSION ENGINE

How to convert die-hard savers into investors as cash keeps piling up?

40

-25

10

Cash is piling up

Everywhere…

EUROPE

“Household saving rate at a record 24.6% while investment rate at 7.9% all time low.”

EurostatNEWS release – 145/2020

GERMANY

“Banks in Germany tell customers to take deposits elsewhere”

The Wall Street JournalWSJ – March 1, 2021

BELGIUM

“Current account balances now even exceed savings account balances”

De StandaardDS – April 8, 2021

How does it work?

A SAAS-BASED SOLUTION IN THREE SIMPLE STEPS

The Conversion Engine goes beyond standard profile-based advice for more traditional investors. It turns wealthy savers into investors by acknowledging their clear preference for savings.

The hyper-personalized journey channels their fear and reluctance by bringing the investment story differently with a lot more focus. It enables an explicit advisory flow with an execution-only feel.

At the end of the process, the wealthy savers gave us a risk profile and an amount ready to be invested.

Business Case

Fertile ground for digital conversion

Cash is available

Yet many banking clients don’t hold any investments. Low penetration rate.

Low interest rates

There REALLY is no alternative.

Mobile is ubiquitous

Everything. Everyone is mobile now!

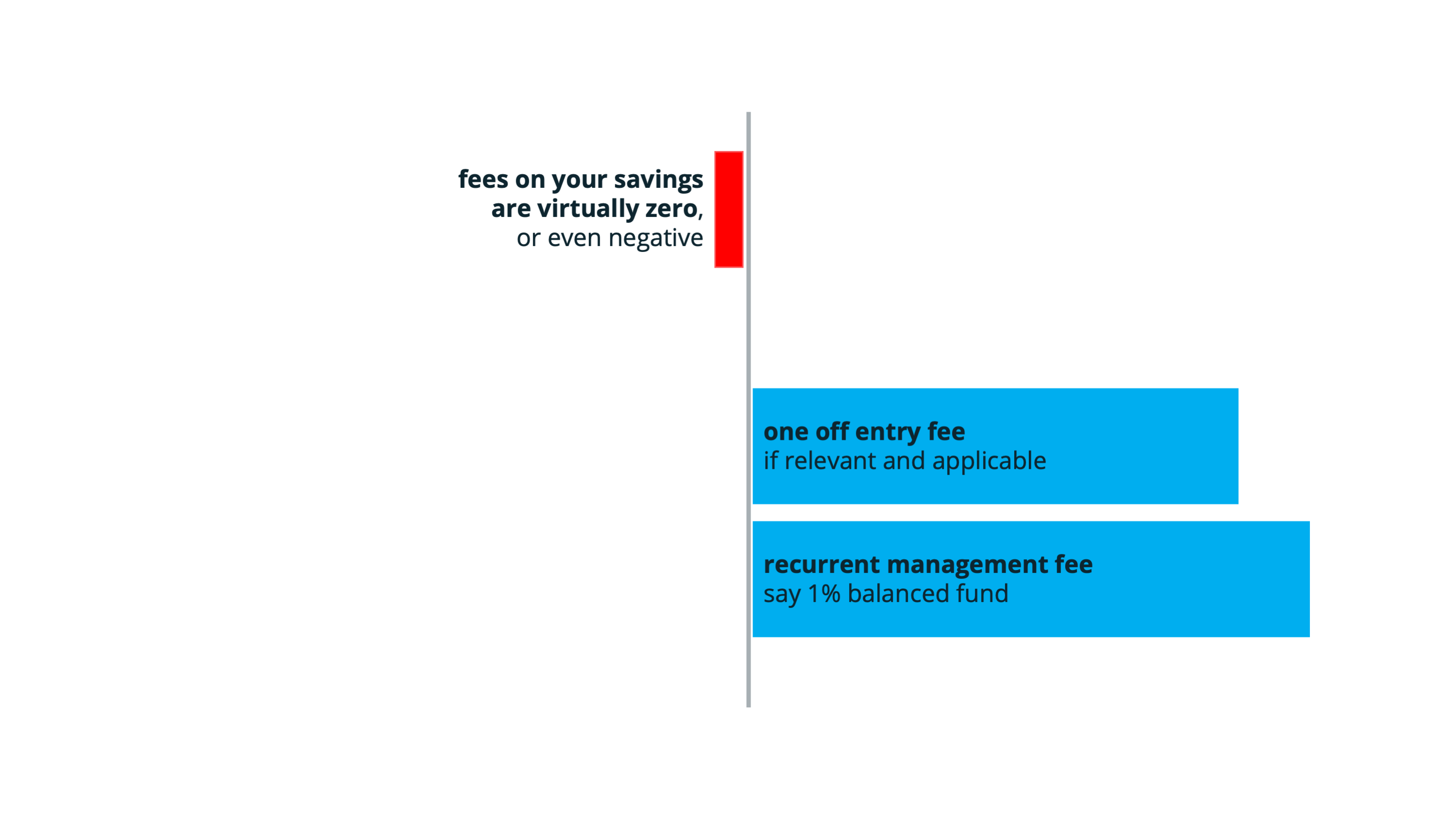

Digital Fee Business

Obvious case: Investments yield more for banks and their clients

- Many banks aim to grow their fee business by converting (part of) their savings into investments through their digital channels

- Our solutions have a proven track record in increasing digital engagement when human encouragement is essential although lacking

- The Conversion Engine particularly targets first-time investors amongst wealthy savers