A Glimpse into the Future of the UK Investment Space

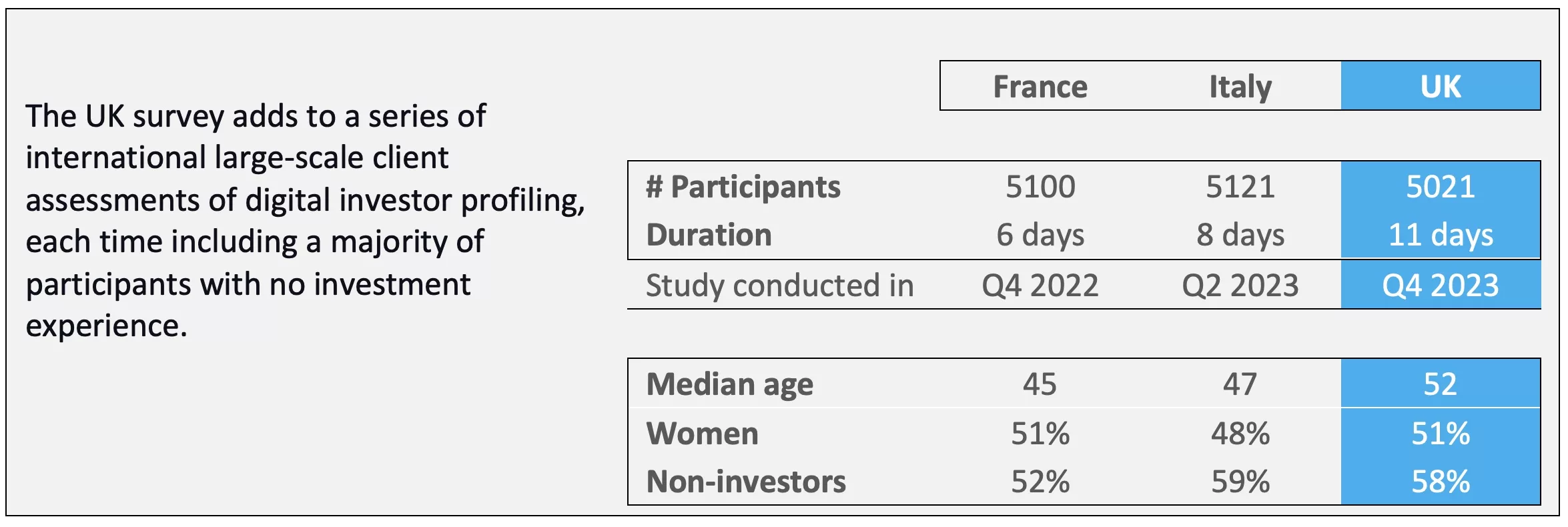

The landscape of banking and investments is on the cusp of a significant transformation, propelled by the rising tide of digital innovation and new regulations. In an ambitious endeavor, we profiled 5,021 UK banking clients in a mere 11 days, showcasing the efficiency of our digital solution, free of human intervention. Moreover, 98% of participants, of which a majority had never invested before, recognized themselves in the result. This feat speaks volumes about the scalability and effectiveness of digital approaches in understanding and serving banking clients.

The survey further addressed topics related to the FCA’s Consumer Duty, and we ensured that the method used current and upcoming regulatory landscapes.

ENGAGEMENT AND ANALYSIS:

The Two Pillars of Digital Profiling

The method used to elicit a person’s risk/reward preferences is designed to engage. The interactive screen flow captivates users, guiding them through a dynamic sequence of personalized choices that do more than just profile; it builds a comprehensive data set that can be used for intricate customer analysis, clustering, and personalization. In just two minutes, we can capture a snapshot of a client’s financial drivers, not only fulfilling regulatory requirements but also setting a new standard in suitability assessment.

THE BEHAVIORAL DIMENSION:

Understanding Investor Psyche

One intriguing aspect revealed by our research pertains to behavioral tendencies, e.g., the balance of gains versus losses, emotionality, and susceptibility to framing. Financial institutions are keen to integrate such behavioral insights into their investor profiling classification, a move encouraged by regulators. Yet, the challenge has always been to find a valid measurement for enhancing their processes. The method used in this survey has successfully bridged this gap, offering a method that is both effective and integrates smoothly with existing workflows. This statement is backed by large-scale user panels in Belgium, Ireland, the Netherlands, France, Italy, and most recently, the UK. Our proactive stance with regulatory bodies across Europe and the UK and initiatives like the current UK survey reflect our commitment to setting a new benchmark for investor profiling.

THE DATA STORIES:

Insights into Consumer Duty and Beyond

Our survey brings to light three compelling narratives, which will be the topic of upcoming blog posts:

- Consumer Duty Interest and Drivers: The survey asked all participants to appreciate particular aspects of their banking relations, such as products and services, price and value, or support for financial well-being. It also asked experienced investors about aspects of their investor relations, such as the inquiry of financial goals and awareness about investment risk.

- Investor Preferences Patterns: Beyond compliance, our method illuminates the subtleties in risk/reward preferences, providing banks with nuanced insights to effectively tailor their services.

- Bank Positioning in the Market: The survey also provides a relative positioning of banks, offering a competitive lens through which financial institutions can benchmark themselves in the digital arena.

EMBRACING DIGITAL TRANSFORMATION:

A Strategic Business Opportunity

Financial institutions must now decide: will they trail behind the regulatory curve or lead the charge into a digitally empowered future? It is no longer sufficient to consider digital transformation as a forced adaptation to regulatory demands. Our findings indicate that this is a strategic business opportunity. Banks that adopt a digital-first approach will not only streamline their processes but also enhance their value proposition to clients.

WANT TO LEARN MORE?

Join us for two groundbreaking webinars unveiling the results of this landmark study with over 5000 UK banking clients. Discover how to enhance financial well-being and investor protection.

Session 1: Future-proof risk-profiling: Empowering investors and advisors

Hosted by everyoneINVESTED

Gain insights how 5000 UK banking clients value future-proof profiling on their risk discovery journey and how this empowers advisors to motivate good outcomes.

Session 2: Goals-based planning: Pushing client-centricity beyond compliance

Hosted by ORTEC Finance

Learn how future-proof suitability based on high quality data links client preferences to the initial allocation and to the ongoing management of portfolios.

Eager to learn more?

Register now and get inspired by Ronald Janssen, Managing Director, ORTEC Finance and Jurgen Vandenbroucke, Managing Director, everyoneINVESTED who will share the results and insights of the UK Market Research

For more webinars, click here