Insights from UK Market Research

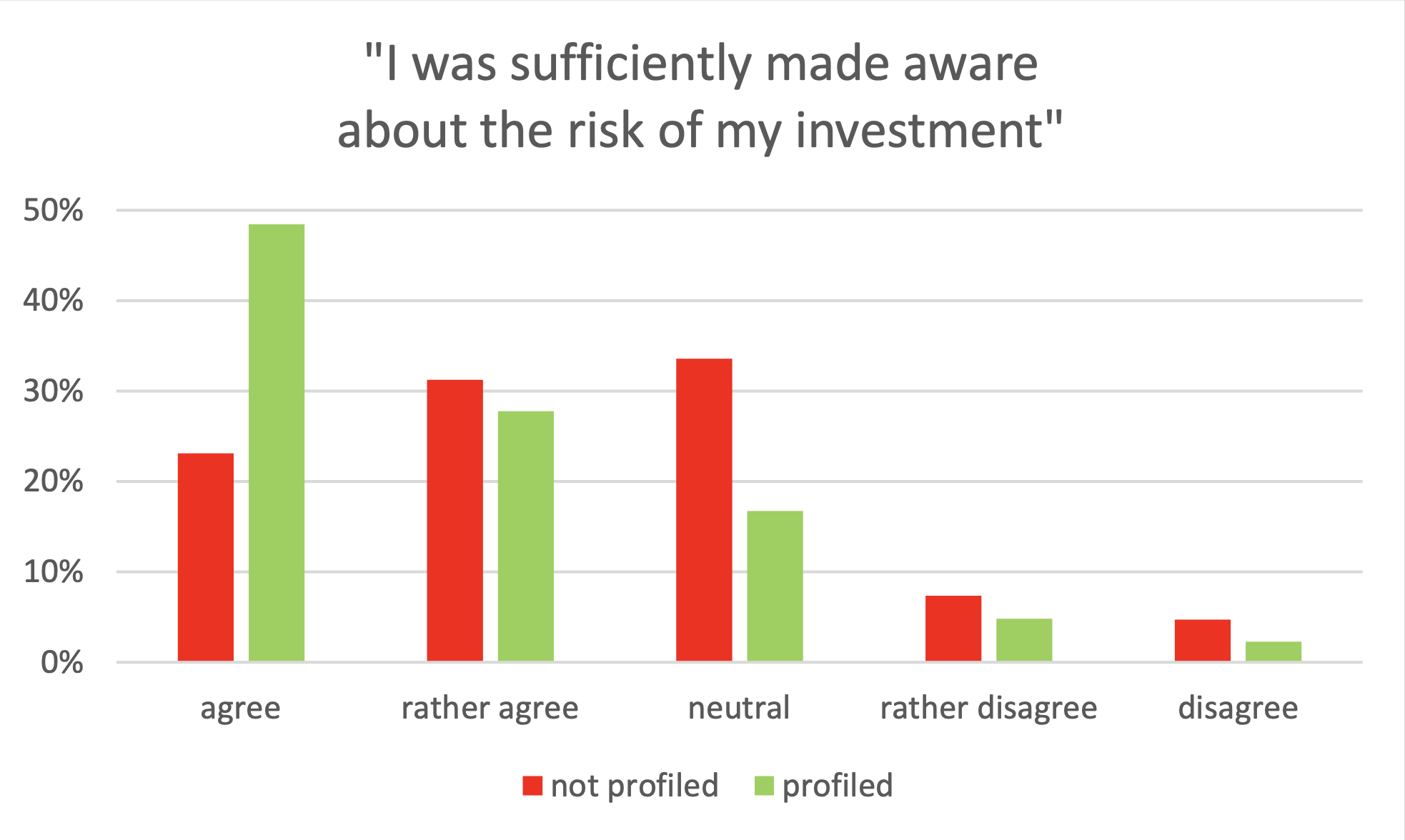

Investment risk is often an elusive concept for many, shrouded in complex terminology and theoretical scenarios. However, our recent market research has shed light on a significant trend: Among the participants with investor experience, especially those profiled before, they agreed that they had been made aware of investment risk.

The survey further addressed topics related to the FCA’s Consumer Duty, and we ensured that the method used current and upcoming regulatory landscapes.

Profiling Advantage in Risk Awareness

The role of digital profiling in enhancing risk awareness cannot be overstated. Profiled individuals with financial objectives and risk tolerance meticulously mapped out showed a much stronger understanding and acknowledgment of investment risk. This suggests that profiling serves as an educational tool, clarifying the often misunderstood aspects of investing. Experienced investors, who already have a foothold in the financial landscape, are better positioned to appreciate the nuances of risk after being profiled. They have a framework that allows them to place new information in context, reinforcing their comprehension and agreement with the principles of risk involved in their investment strategies.

Age as a Differentiating Factor

Interestingly, while profiling stood out as a primary risk awareness contributor, age emerged as a – less impactful yet significant – differentiator. Profiled or not, older investors demonstrated a slightly stronger agreement regarding being made aware of investment risk compared to their younger counterparts. This could be attributed to various factors: a longer time horizon to experience market fluctuations, a greater exposure to different investment scenarios, or perhaps a more conservative approach to wealth preservation as retirement looms closer. Whatever the underlying reasons, it is evident that age and experience contribute to a more profound recognition of investment risk.

Digital Profiling as the Pathway to Empowerment

Digital profiling emerges as a method for more personalized data-based servicing and a vital educational thread in the investor’s journey. The agreement on risk awareness among profiled investors reaffirms the value of this approach. Financial institutions and advisors are thus called upon to prioritize profiling as a cornerstone of their service, ensuring investors of all ages, especially the young, know how to navigate the investment landscape confidently and effectively.

Impact of profiling on risk awareness

Participants in the survey who claimed to have investment experience were presented with several questions gauging the investment services they had experienced. In the UK survey, 2111 of the 5021 participants, or 42%, have investor experience. Amongst those 2111 experienced investors, 868 stated they had been risk profiled before.

WANT TO LEARN MORE?

Join us for two groundbreaking webinars unveiling the results of this landmark study with over 5000 UK banking clients. Discover how to enhance financial well-being and investor protection.

Session 1: Future-proof risk-profiling: Empowering investors and advisors

Hosted by everyoneINVESTED

Gain insights how 5000 UK banking clients value future-proof profiling on their risk discovery journey and how this empowers advisors to motivate good outcomes.

Session 2: Goals-based planning: Pushing client-centricity beyond compliance

Hosted by ORTEC Finance

Learn how future-proof suitability based on high quality data links client preferences to the initial allocation and to the ongoing management of portfolios.

Eager to learn more?

Register now and get inspired by Ronald Janssen, Managing Director, ORTEC Finance and Jurgen Vandenbroucke, Managing Director, everyoneINVESTED who will share the results and insights of the UK Market Research

For more webinars, click here