Field Research

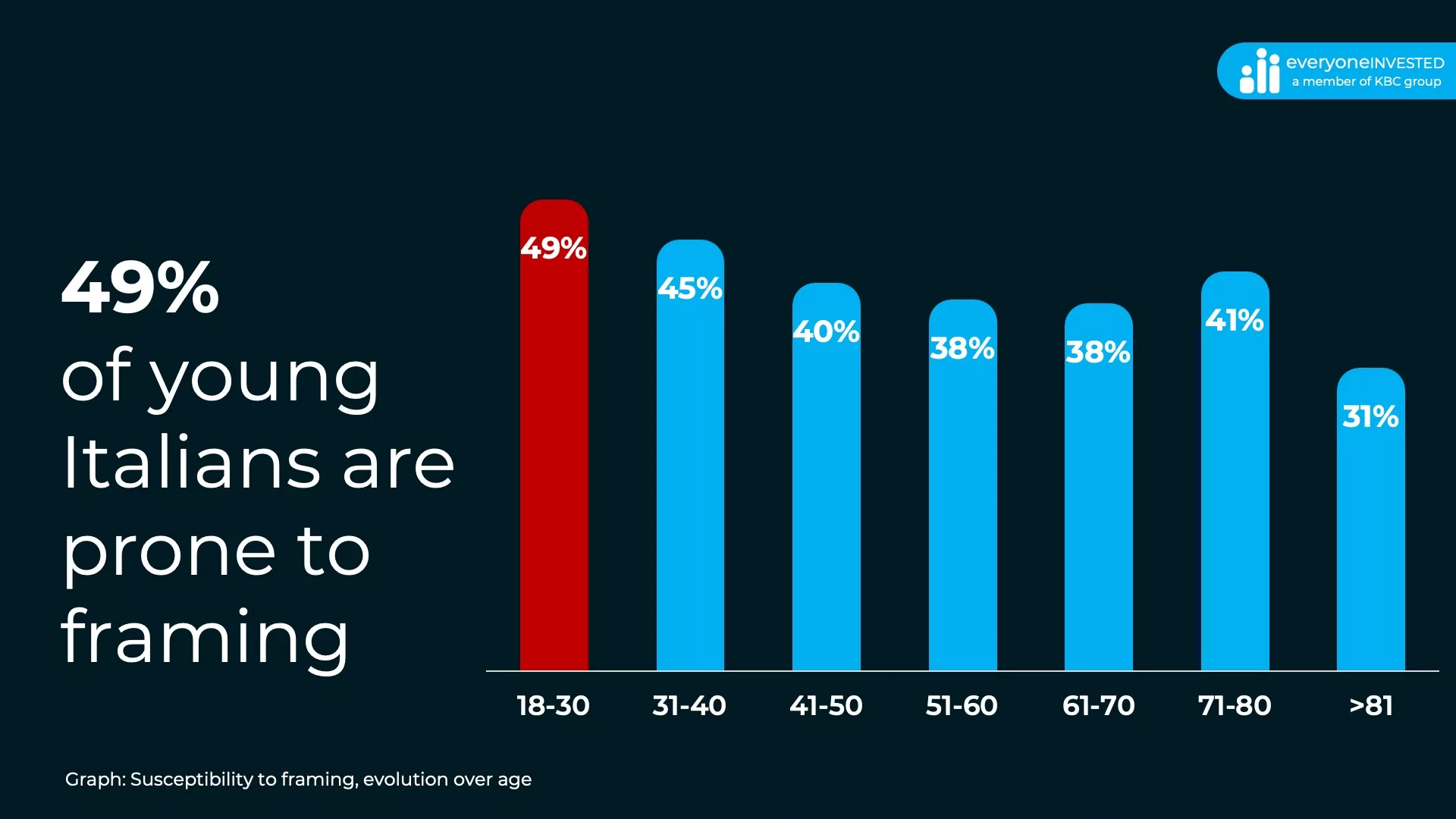

Contrary to the passionate and impulsive stereotype, Italians show more composure and less emotionality than other Europeans when balancing positive and negative change. They are however as prone to framing as the other Europeans. In the intricate world of financial decision-making, individuals, particularly the youth, often find themselves entangled in their own decisions. Luckily, the susceptibility to framing significantly reduces with age.

Framing has consistently been shown to be one of the most significant biases in decision-making. But how prevalent is framing? In our recent Italian study, we had 5121 Italian banking clients digitally complete their risk profile using an alternative, engaging method rooted in decision science. The results shed light on an innovative approach that acknowledges, measures,and can help mitigate framing.

UNRAVELING THE FRAMING EFFECT

In multiple studies, researchers have found that students were more likely to prefer options framed positively. For example, they are more likely to enjoy meat labeled 75% lean meat as opposed to 25% fat, or use condoms advertised as being 95% effective as opposed to having a 5% risk of failure.

The framing effect in decision-making refers to the variance in choices when the same problem is presented in different ways. An individual might opt for a risk-averse choice when positive outcomes are highlighted and veer towards loss-avoidant options when the negative consequences are underscored.

INFLUENCING BEHAVIOR

People are often provided with options within the context of only one of the two frames, sometimes resulting in undesired consequences, e.g., in the context of investing, some peoplecould, when confronted with sudden market corrections, push more quickly on the sell button than they would have anticipated. Other people might take bigger risks than they initially thought and gamble their way out to avoid a loss.

REMARKABLE TREND

Our Italian study offered individual-level insights but also highlighted that 49% of young Italians swayed under the framing influence, while seniors exhibited an uncanny ability to break free as the impact wanes with age.

BALANCING ACT

Navigating through the world of finance can sometimes feel like walking a tightrope, especially for the younger generation. Every step and every decision is a balancing act between the rational and the emotional, the informed and the impulsive. The methodology used acknowledges and measures this framing effect at an individual level, enabling financial institutions to help each of their clients – especially the younger ones – actually to help them make better-informed decisions.

IMPROVING FINANCIAL WELL-BEING

When discussing financial decisions, it’s often a mix of cold, hard numbers and that gut feeling. While the actual journey of financial decision-making, especially for the youth, is often painted with the strokes of positive and negative frames, subtly guiding choices and actions.

Financial institutions are not bystanders in this journey. Armed with insights from studies like these, banks can build the tools to measure, craft and offer more suitable advice down to the individual level. They can personalize their communication – depending on the susceptibility to framing – to help their clients make better financial decisions, even beyond investing. Hence, they can play a pivotal role in making financial well-being less of a tightrope walk and more of a well-lit pathway.

Eager to learn more?

We digitally profiled 5121 Italian banking clients in less than 6 days without any human intervention. Another way to approach potential investors at a fraction of the cost! Curious about more insights? How you compare to other banks?